NeuquenNews

INTERNACIONALES17/01/2026El aumento de la violencia institucionalizada por el Estado bajo la administración de Donald Trump —especialmente a través de ICE— ha llevado a un punto de ruptura en el tejido social de Estados Unidos. Denuncias de abusos, muertes bajo custodia, represión de movilizaciones y la militarización de la aplicación de leyes migratorias explican por qué reaparecen discursos y prácticas similares a las del movimiento original de las Panteras Negras. Un análisis claro de hechos y patrones documentados.

NeuquenNews

HORÓSCOPO CHINO20/01/2026Martes de avance concreto, decisiones prácticas y coherencia entre intención y acción. El martes 20 de enero de 2026 trae una energía más activa y resolutiva que la del lunes. Ya no alcanza con ordenar o planificar: el día pide poner en movimiento lo que se decidió, aunque sea en pasos pequeños. Es una jornada ideal para destrabar pendientes, tomar definiciones prácticas y avanzar sin exceso de análisis.

NeuquenNews

POLÍTICA19/01/2026El reciente cruce público entre dirigentes políticos sobre la política impositiva de la Municipalidad de Neuquén no es un hecho aislado: resume tensiones profundas en torno al papel del Estado y su financiamiento en un contexto de ajuste económico nacional. Según lo reflejó el portal neuquenweb, el enfrentamiento se dio entre Nadia Márquez, senadora nacional por La Libertad Avanza, y Claudio Domínguez, diputado provincial del Movimiento Popular Neuquino (MPN), a partir de las denominadas tasas retributivas, un conjunto de tributos municipales cuyo aumento fue cuestionado en las redes sociales.

Neuquén Noticias

REGIONALES19/01/2026El Sindicato de Obreros y Empacadores de Río Negro y Neuquén acordó con la Cámara Argentina de Fruticultores Integrados un salario que supera los 2 millones de pesos para la temporada 2026. El secretario general Marcos Bielma destacó que el convenio garantiza una mejora interanual superior al 31%, consolidando un avance significativo para los trabajadores del sector.

NeuquenNews

ACTUALIDAD19/01/2026Agostina Páez, una abogada e influencer argentina de 29 años, fue retenida por la justicia brasileña en Río de Janeiro luego de que se viralizara un video en el que, durante una discusión con empleados de un bar en el barrio de Ipanema, realizó gestos y comentarios considerados racistas hacia los trabajadores del local.

Neuquén Noticias

ENERGÍA19/01/2026La compañía presentó un nuevo formato de garrafas fabricadas en material plástico, que pesan hasta un 65% menos que las tradicionales de chapa. El objetivo es mejorar la comodidad en el traslado y la seguridad en el uso cotidiano, ofreciendo una alternativa más práctica para los hogares.

NeuquenNews

SALUD Y BIENESTAR20/01/2026Más de 40 países ya impulsan leyes para restringir el acceso de menores a las redes sociales. El foco dejó de estar en la autorregulación de las plataformas y pasó a la protección activa de la salud mental, el desarrollo y la privacidad de niños y adolescentes.

Neuquén Noticias

REGIONALES20/01/2026La Municipalidad amplió el beneficio que antes era por seis meses. El coordinador de Desarrollo Económico, Gastón Contardi, destacó que la medida busca sostener el crecimiento comercial tras un año récord de aperturas en la ciudad.

NeuquenNews

REGIONALES20/01/2026El intendente Gonzalo Nuñez suscribió un acuerdo con la empresaria Antonella Ferracioli para impulsar un proyecto público-privado que prevé la creación del primer Parque Industrial Verde (Sostenible) de la provincia en San Patricio del Chañar, con inversión privada.

Neuquén Noticias

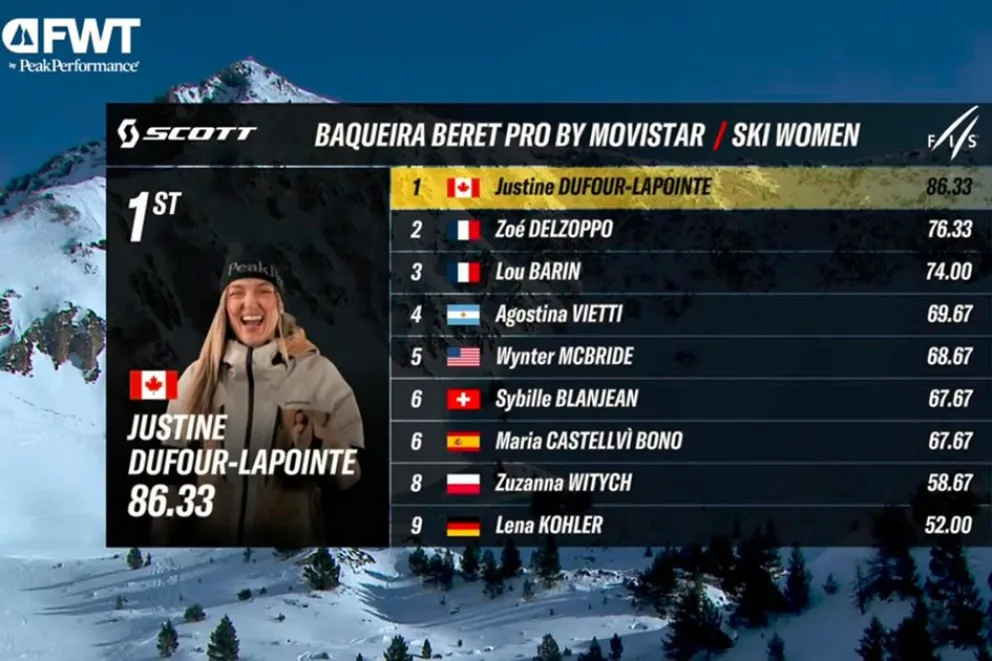

ACTUALIDAD - DEPORTES20/01/2026Agostina Vietti es la primera atleta mujer argentina y sudamericana que clasificó para competir en esquí en el Freeride World Tour 2026. Continuará participando de las próximas fechas, así como del Mundial de Freeride FIS junto al equipo argentino.